Our 2030 Vision

To cover all 55 African Union countries and the 700 million people whose economic livelihoods and lives are at risk due to climate change

ARC Ltd. provides parametric insurance services to AU Member States and farmer organisations, employing innovative financing mechanisms to pool disaster-related risk across Africa and transferring it to international risk markets.

In so doing, it improves the continent’s response to climate-related disasters and contributes to resilience building and ultimately to food security.

Efforts are ongoing to ensure the ARC product portfolio is reflective of the needs of Member States and provides progressive solutions to weather-related disasters.

Total claims paid out since 2014

WELCOMED

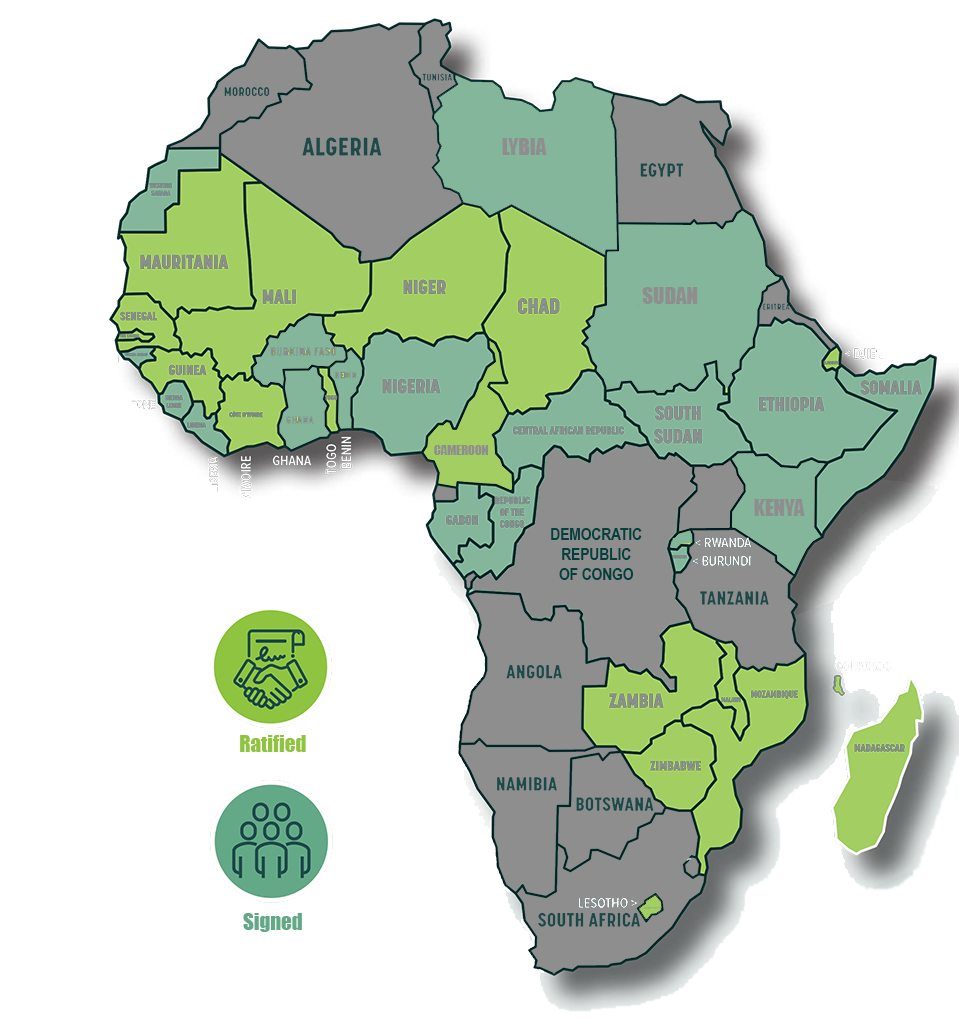

Our Footprint

Our Member States

Reports & Downloads

Access Comprehensive Insights and Resources at Your Fingertips

Discover Insights

News

PLUS DE 29 MILLIONS DE DOLLARS MOBILISÉS POUR SOUTENIR MADAGASCAR

Antananarivo, 5 mars 2025 — Plus de 29 millions de dollars ont été mobilisés pour appuyer la réponse et le relèvement de Madagascar à la suite du passage des cyclones

OVER USD 29 MILLION MOBILISED TO SUPPORT MADAGASCAR

Antananarivo, 05 March 2025 — More than USD 29 million has been mobilised to support Madagascar’s response and recovery following tropical cyclones Fytia and Gezani through a combination of pre-arranged

RAPID FLOOD RESPONSE FUNDING

Malawi and Mozambique secure over USD22.3 million within seven days Abidjan, 30 January 2026 – The Regional Emergency Preparedness and Access to Inclusive Recovery (REPAIR) Program has disbursed over USD22.3

Driving Climate Resilience Through Innovation: Regional Risk Pools Advance Global Action Ahead of COP30

As COP30 convenes under the banner of accelerating climate finance and adaptation, the Resilience Risk Pools alliance — comprising the African Risk Capacity Limited (ARC Ltd.), CCRIF SPC (the Catastrophe

ARC LTD. UNVEILS INCLUSIVE CLIMATE PROTECTION INITIATIVE AND WINS GLOBAL AWARD FOR INNOVATION

Johannesburg, 29 October 2025 – Millions of Africans vulnerable to droughts, floods, and other climate-related disasters will soon have access to new, Shariah-compliant protection solutions thanks to a bold new

ARC makes a combined parametric insurance payout of $5.4 million to support Mozambique’s response to the 2024/25 drought and to Tropical Cyclone Chido

Maputo, Mozambique – 14 October 2025 – Today, the African Risk Capacity (ARC) Group presented an insurance payout of just over $5.4 million to the Government of the Republic of Mozambique

Case Studies

CASE STUDY: 2022 IMPACT

A year of impact & value – a record US$60m in payouts 2022 was the year in which ARC Ltd. intentionally set out to demonstrate value, impact and meaning on

CASE STUDY: OUTBREAKS AND EPIDEMICS

According to healthcare experts, Africa has one of the weakest health systems in the world, making it prone to epidemics and outbreaks. This was evident in the 2014-2016 Ebola epidemic

CASE STUDY: FLOOD RISK IN NIGERIA

Droughts and floods have had the most significant humanitarian impact in Africa in recent decades. According to the World Meteorological Association, drought-related hazards in the last 50 years have left

CASE STUDY: MADAGASCAR

Four disaster climate events in two months Due to its geographical position, Madagascar is one of the African countries hardest hit by the impact of climate change. Cyclones batter the

CASE STUDY: MALI

The last 10 years in Mali have been characterised by conflict and political insecurity. The country has been rocked by three military coups during this time and human rights violations

CASE STUDY: MAURITANIA

Crippled by compounded factors Mauritania, a lower-middle-income country in north-west Africa, is buckling under food insecurity. It is situated in the Sahel region – a semi-arid region of Africa bordered

Our Partners

Fight against climate change in Africa.