Africa's first

parametric development insurer

for climate risks

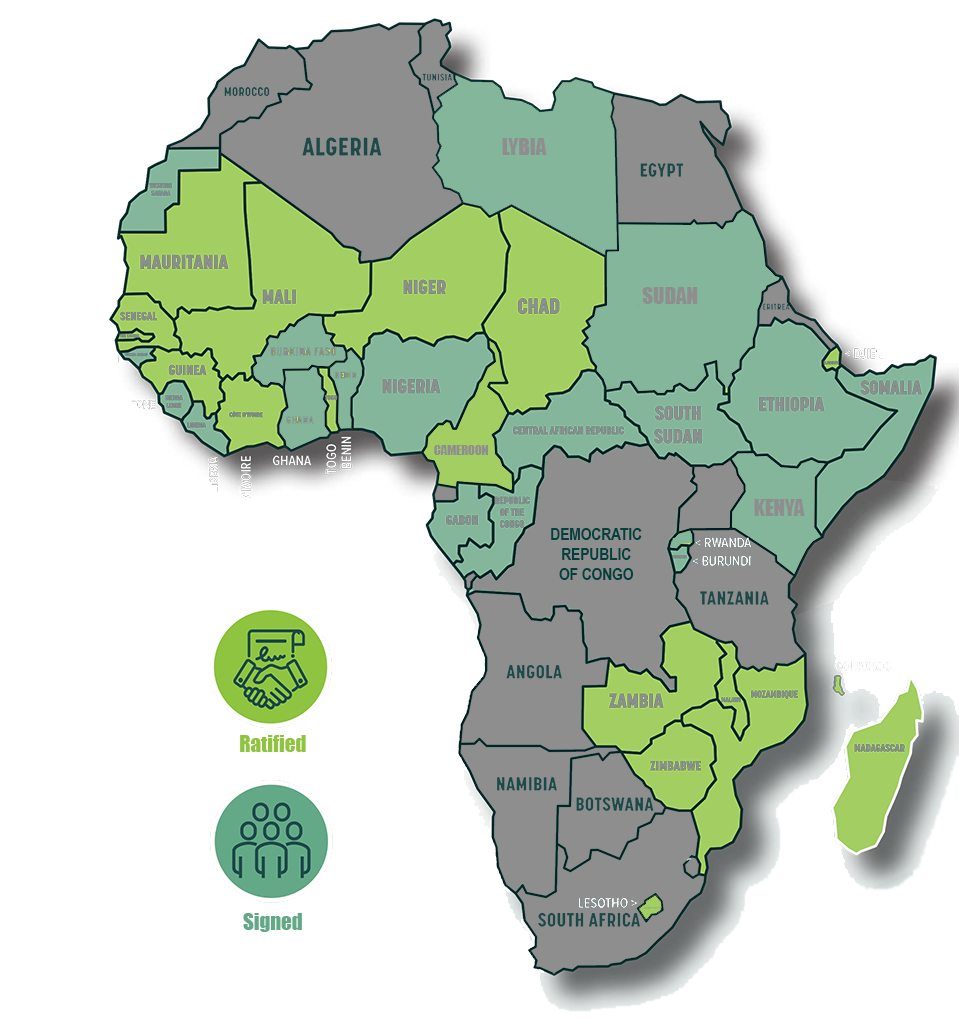

Founded in 2014, the African Risk Capacity Limited (ARC Ltd.) is a hybrid mutual insurer and financial affiliate of the African Risk Capacity Group

Founded in 2014, the African Risk Capacity Limited (ARC Ltd.) is a hybrid mutual insurer and financial affiliate of the African Risk Capacity Group

ARC Ltd. provides parametric insurance services to AU Member States and farmer organisations, employing innovative financing mechanisms to pool disaster-related risk across Africa and transferring it to international risk markets.

In so doing, it improves the continent’s response to climate-related disasters and contributes to resilience building and ultimately to food security.

Efforts are ongoing to ensure the ARC product portfolio is reflective of the needs of Member States and provides progressive solutions to weather-related disasters.

Total claims paid out since 2014

Maseru, Lesotho – 22 August 2025 – The African Risk Capacity (ARC) Group today issued a US$2,767,958 insurance payout to the Government of the Kingdom of Lesotho, following the activation

Lilongwe, Malawi – 25 July 2025: Today, the Government of the Republic of Malawi has received an insurance payout from the African Risk Capacity (ARC) Group to the sum of

Angola, Burundi, Malawi, Seychelles and Zambia join REPAIR for rapid access to disaster response funding Johannesburg, July 24, 2025 – The World Bank has approved the accession of Angola, Burundi,

Lusaka, Zambia – 28 April 2025 — ARC Ltd and Klapton Reinsurance Limited (Klapton Re) have today signed a Memorandum of Understanding (MoU) in Lusaka, Zambia, announcing a new partnership

A year of impact & value – a record US$60m in payouts 2022 was the year in which ARC Ltd. intentionally set out to demonstrate value, impact and meaning on

According to healthcare experts, Africa has one of the weakest health systems in the world, making it prone to epidemics and outbreaks. This was evident in the 2014-2016 Ebola epidemic

Droughts and floods have had the most significant humanitarian impact in Africa in recent decades. According to the World Meteorological Association, drought-related hazards in the last 50 years have left

Four disaster climate events in two months Due to its geographical position, Madagascar is one of the African countries hardest hit by the impact of climate change. Cyclones batter the

The last 10 years in Mali have been characterised by conflict and political insecurity. The country has been rocked by three military coups during this time and human rights violations

Crippled by compounded factors Mauritania, a lower-middle-income country in north-west Africa, is buckling under food insecurity. It is situated in the Sahel region – a semi-arid region of Africa bordered